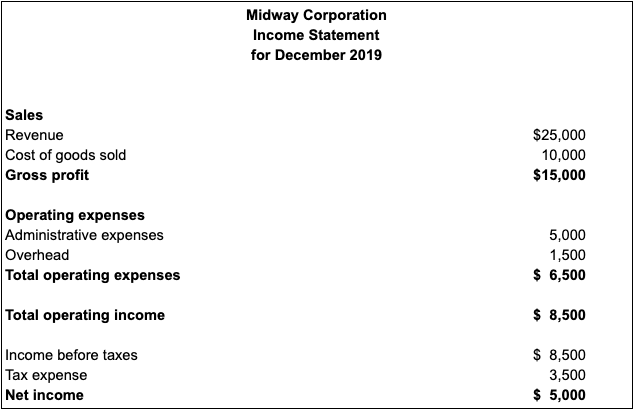

It is important to note that Net Receivables has to be considered here and not Gross Receivable. Now, let us also take a look at total assets for both the companies.Īverage Receivables balance for both the companies can be obtained from the current assets section of the Balance Sheet. Hence, the question of receivable balance does not arise.Ĭredit sales value for both the companies can be obtained from the income statement. It is important to note that only credit sales need to be considered and not total sales.īecause in the case of cash sales, the company will always receive payment for the goods or services it renders. To calculate the debtor turnover ratio, we need Values given in the examples below are in $ millions.Ĭonsider the below-given income statement for both the companies. We take Company A and Company B for calculating DTR. Let us understand the debtor turnover ratio formula with a hypothetical example. Such customers are given a credit period (time period) to make the payment.Īverage receivables are nothing but a simple average of closing balance of receivables as at the current period and previous period.

We take C redit sales in the numerator and Average Receivables in the denominator.Ĭredit sales are the sales made by the company to customers without receiving cash. The debtor turnover ratio formula is quite logical.

It indicates the efficiency of the collection department of the company. Receivable turnover ratio explains how many times its debtor balance outstanding were turned over during a given period, generally a year. The money owed to the company by such buyers is shown on the Balance Sheet as “Receivables” or “Debtors”. Such sales are called as credit sales.īuyers who purchase goods or services from the company on credit are called Receivables or Debtors. When the company makes a sale of a product or service, it often provides a certain credit period for the buyer to make the payment.

Receivable turnover ratio or debtor turnover ratio is an activity ratio that indicates the efficiency of the company in managing its receivable balance.

0 kommentar(er)

0 kommentar(er)